how to pay indiana state withholding tax

All payments must be made with US. The best and easiest way to complete a WH-1 is through INTIME Indianas Taxpayer Information Management Engine DORs e-services portal.

Free Indiana Payroll Calculator 2022 In Tax Rates Onpay

Companies who pay employees in Indiana must register with the IN Department of Revenue for a Taxpayer ID Number and the IN Department of Workforce Development for a SUTA Account Number.

. Divide the annual Indiana tax withholding by 26 to obtain the biweekly Indiana tax withholding. Claim a gambling loss on my Indiana return. Repeat for each applicable employee.

File my taxes as an Indiana resident while I am in the military but my spouse is not an Indiana resident. Write your Social Security number on the check or money order. Your withholding is subject to review by the IRS.

Pay Taxes Electronically Customers can quickly and securely pay their taxes electronically. You can pay those Indiana state taxes due directly online to Indiana at the web site address here select Individual Tax Return. Enter Personal Information a First name and middle initial.

Give Form W-4 to your employer. 2 Number of exemptions claimed for certain qualifying dependents. Enclose your check or money order made payable to the Indiana Department of Revenue.

Upload W2s W2Gs and. INTAX only remains available to file and pay special tax obligations until July 8 2022. Rates do increase however based on geography.

Make a payment online with INTIME by electronic check bankACH - no fees or debitcredit card fees apply Make a payment in person at one of DORs district offices or downtown Indianapolis location using cash exact change only personal or cashiers check money order and debitcredit cards fees apply. City or town state and ZIP code. New field is labeled County subject to withholding select the applicable county.

To register for Indiana business taxes please complete the Business Tax Application. Place the Box 1 total on line 21 of the 1040 and place the Box 2 sum on the line designated as federal income tax withheld. Last name Address.

Once in the employee record. If you do not file a return and pay the proper amount of tax you will face criminal prosecution for fraud or tax evasion. 99999 99999 999 or 99999 99999 999 9 13 or 14 digits.

You are still required to report all your gambling winnings from the year on the form 1040. You may also need to complete the FT-1 application for motor fuel taxes including special fuel or transporter taxes or the AVF-1 application for aviation fuel excise tax. The Indiana Department of Revenue DOR is transitioning tax accounts to its new online e-services portal INTIME which currently offers the ability to manage most tax accounts in one convenient location at intimedoringov.

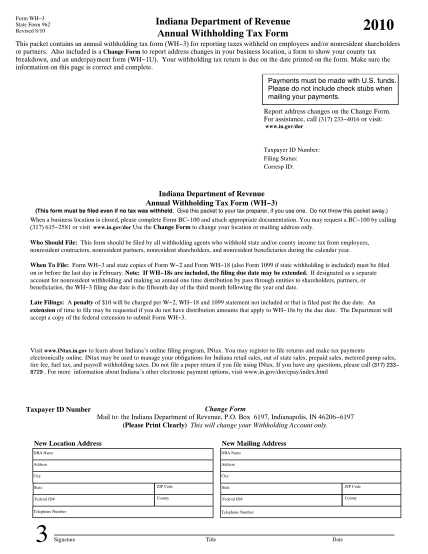

Download Now Employers required by the Internal Revenue Service to withhold income tax on wages must register with the Indiana Department of Revenue DOR as a withholding agent online through INBiz httpinbizingov. Find Indiana tax forms. Complete Form W-4 so that your employer can withhold the correct federal income tax from your pay.

Know when I will receive my tax refund. Families who dont owe taxes to the IRS can still file their 2021 tax return and claim the Child Tax Credit for the 2021 tax year at any point until April 15 2025 without any penalty. Pay my tax bill in installments.

Have more time to file my taxes and I think I will owe the Department. Click the Other tab. Credit card payments may be made through the Ohio Business Gateway OBG or over the Internet by visiting the ACI Payments Inc.

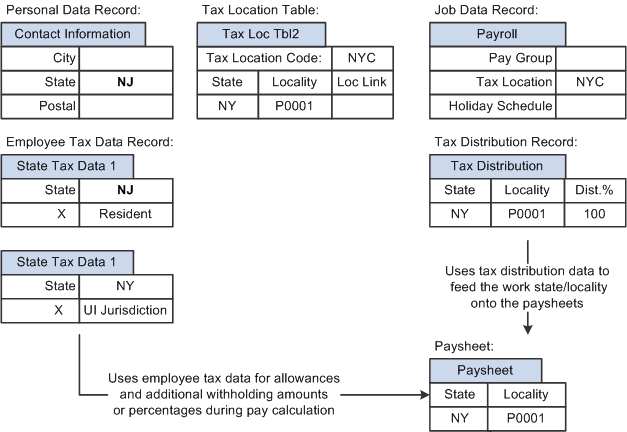

Unlike the federal income tax system rates do not vary based on income level. If an employee resides in Lake County the only Indiana county which has not adopted county tax or out-of-state on January 1 2013 but works in another Indiana county on New Years Day the employees county tax withholding should. Take the renters deduction.

Generally county income tax should be withheld based on each employees county of residence on NewYears Day of each year. Accessing from Payroll Setup. Apply online using the IN BT-1 Online Application and receive a.

This year also marks the first time in history that many families with children in Puerto Rico will be eligible to claim the Child Tax Credit which has been. Click the Payroll Info tab. Multiply the taxable income computed in step 4 by 323 percent to obtain the annual Indiana tax withholding.

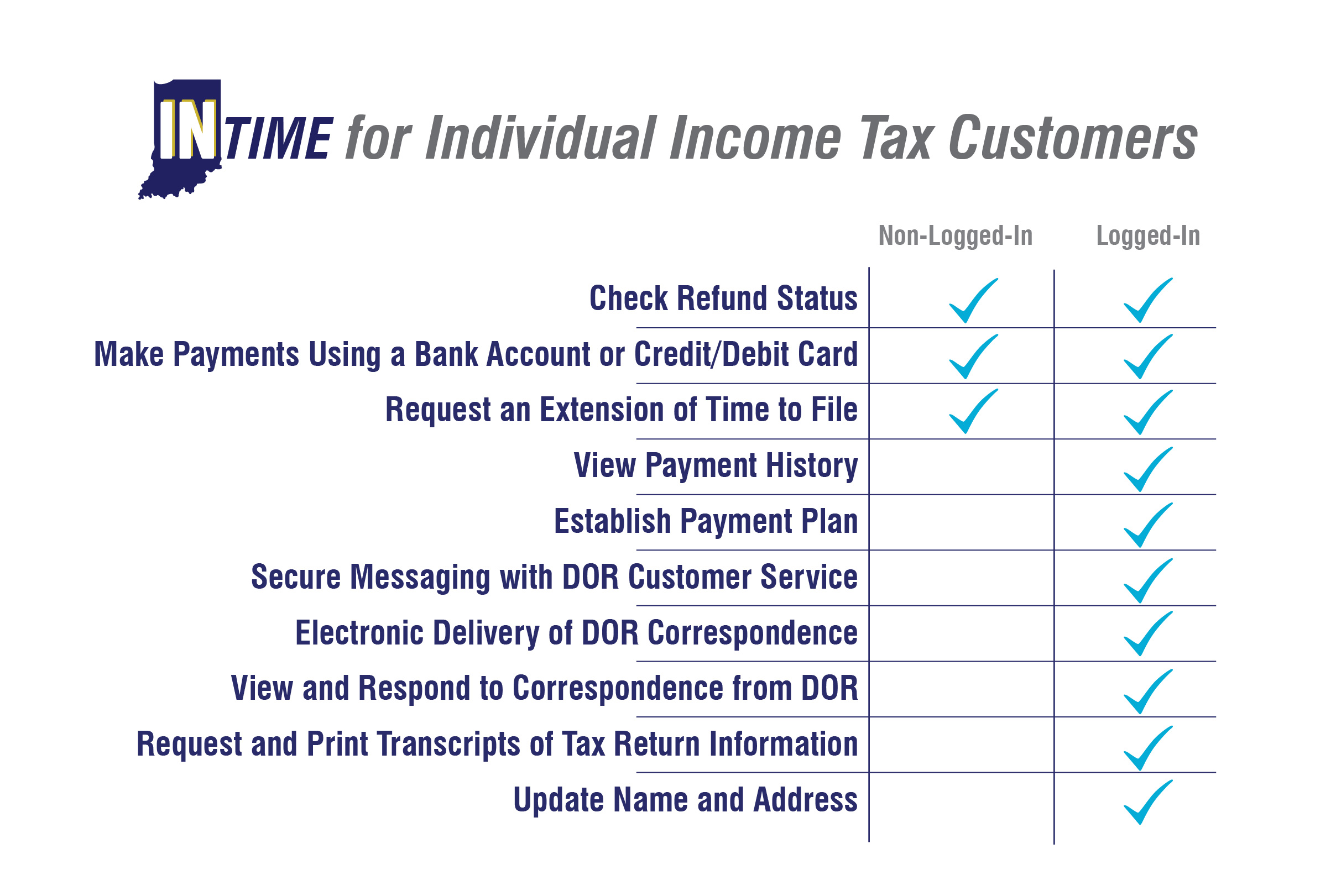

From the Item Name list select Indiana Counties Tax. Pay the amount due on or before the installment due date. The Indiana Department of Revenue DOR is transitioning tax accounts to its new online e-services portal INTIME to offer the ability to manage tax accounts in one convenient location 247.

The aggregate of Indian state income tax and local tax applicable in a county within the state of Indiana are taken along with the allowed personal exemption and exemption for dependentsYou can also check federal paycheck tax calculator. Once registered an employer will receive an Indiana Taxpayer Identification Number. State Form 48845 R2 8-08 Instructions for Completing Form WH-4 This form should be completed by all resident and nonresident employees having income subject to Indiana state andor county income tax.

Additional Allowance 1500 x Number of Additional Exemptions 2. Indiana has a flat state income tax rate of 323 for the 2021 tax year which means that all Indiana residents pay the same percentage of their income in state taxes. INTIME allows you to file and pay your business taxes including sales and withholding.

Withholding payments must be made to DOR by the due dates or penalties and interest will be assessed. INtax only remains available to file and pay the following tax obligations until July 8 2022. Indiana tax calculator is an easy tool for computing the amount of withholding tax on your salary income.

IN Taxpayer ID Number. Print or type your full name Social Security number or. There is a service fee charged by ACI Payments Inc.

Payment Plan Set up a payment plan online INBIZ Indianas one-stop resource for registering and managing your business and ensuring it complies with. Even if the game operator didnt do its job and you didnt receive a W-2G that doesnt mean youre off the hook. You can also make your estimated tax payment online via INTIME at intimedoringov.

You can use your American Express DiscoverNOVUS MasterCard or Visa credit card to pay your withholding tax liability. If you are required to withhold federal taxes then you must also withhold Indiana state and county taxes.

State Income Tax Withholding Considerations A Better Way To Blog Paymaster

Peoplesoft Payroll For North America 9 1 Peoplebook

Irs Form 945 How To Fill Out Irs Form 945 Gusto

16 Printable Indiana State Tax Withholding Form Templates Fillable Samples In Pdf Word To Download Pdffiller

A Basic Overview Of Indiana S Wh 4 Form For State Tax Withholding

Calculating Your Withholding Tax Inside Indiana Business

State W 4 Form Detailed Withholding Forms By State Chart

Indiana Taxes For New Employees Asap Payroll Services

State W 4 Form Detailed Withholding Forms By State Chart

Tax Withholding For Pensions And Social Security Sensible Money

How Taxes Work Taxes Social Security Numbers Visas Employment Office Of International Affairs Indiana University Purdue University Indianapolis

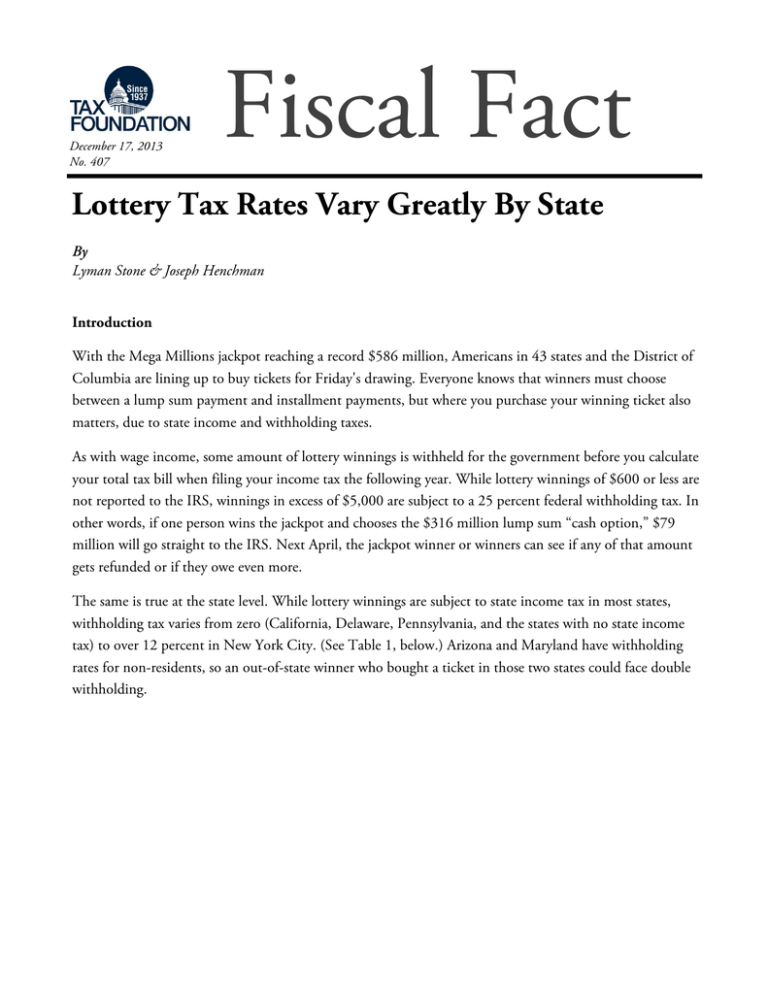

Lottery Tax Rates Vary Greatly By State

16 Printable Indiana State Tax Withholding Form Templates Fillable Samples In Pdf Word To Download Pdffiller

19 Indiana Tax Forms Free To Edit Download Print Cocodoc

A Basic Overview Of Indiana S Wh 4 Form For State Tax Withholding